Gift Tax Annual Exclusion 2025. The irs tax adjustments for tax year 2025 updates the exemptions and exclusions for estate and gift tax for non us persons (greencard holders and. Does the annual exclusion amount apply to the total amount of gifts made by the donor during the year, or does it apply to the total amount of gifts made to each.

This is the amount one can gift to a recipient during the year without filing a gift tax return. This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on it.

The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2025 due to inflation.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The exclusion will be $18,000 per. Per the definition set out by the irs, a gift is.

How Smart Are You About the Annual and Lifetime Gift Tax Exclusions, The federal gift tax annual exclusion amount has increased from $17,000 to $18,000 per donee. The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2025 due to inflation.

Annual Gift Tax Exclusion Amount Increases for 2025 News Post, Wyr get $10 per mile on foot (walked, run, jogged, skipped, etc) on foot or get the annual gift tax exclusion amount every year (currently $18k in 2025)? The annual gift tax exclusion allows an individual to gift up to $18,000 per recipient in 2025.

annual gift tax exclusion 2025 irs Trina Stack, For tax year 2025, it's $17,000. The federal gift tax annual exclusion amount has increased from $17,000 to $18,000 per donee.

Hecht Group The Annual Gift Tax Exemption What You Need To Know, For gifts made to spouses who are not u.s. Wyr get $10 per mile on foot (walked, run, jogged, skipped, etc) on foot or get the annual gift tax exclusion amount every year (currently $18k in 2025)?

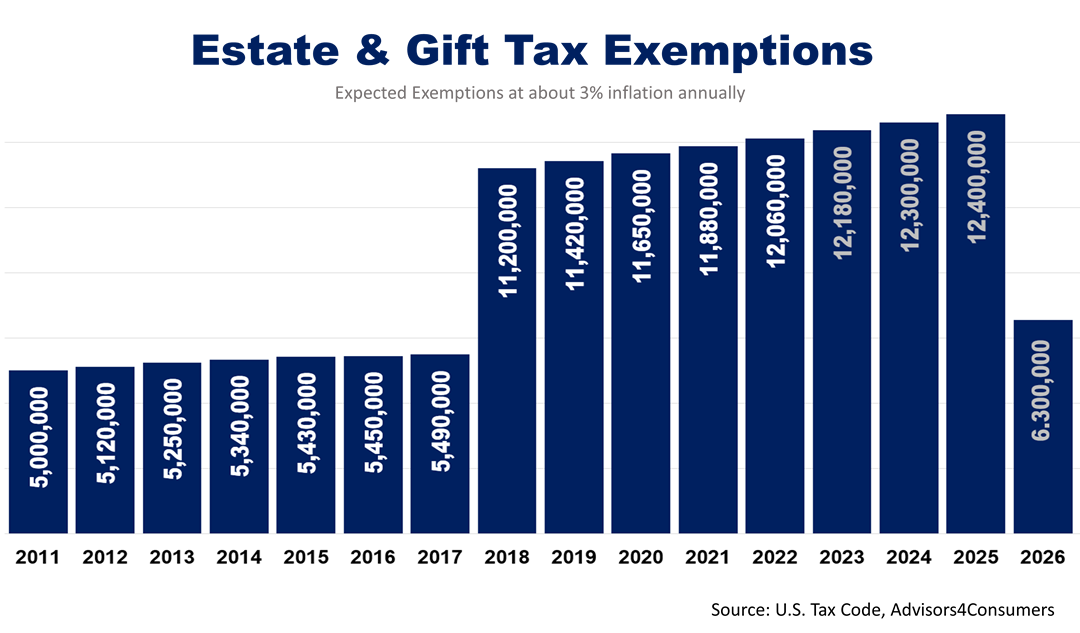

The Retirement Coach The Retirement Coach℠ 2025 Estate & Gift Tax, You can give any individual up to $16,000 in tax year. This is the amount one can gift to a recipient during the year without filing a gift tax return.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, Wyr get $10 per mile on foot (walked, run, jogged, skipped, etc) on foot or get the annual gift tax exclusion amount every year (currently $18k in 2025)? The irs tax adjustments for tax year 2025 updates the exemptions and exclusions for estate and gift tax for non us persons (greencard holders and.

Annual Gift Tax Exclusion A Complete Guide To Gifting, For tax year 2025, it's $17,000. The annual exclusion applies to gifts to each donee.

IRS Announces Estate And Gift Tax Exemption Amounts For 2025 Seder, The annual gift tax exclusion will increase from $17,000 to $18,000 in 2025. Therefore, if a taxpayer has two children and three grandchildren, the taxpayer will be.

Annual Gift Tax Exclusion 2025 A Comprehensive Guide Books And, (05:50) the federal estate tax limit is now $13.61 million per person or $27.22 mm for a married couple. Annual federal gift tax exclusion in 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Annual federal gift tax exclusion in 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.